Retirement marks the beginning of a new chapter in life—one filled with well-earned rest, adventure, or time spent with family. For many business owners, the journey to retirement includes a crucial step: selling their business. This process can be complex, emotionally charged, and financially significant, making it vital to approach it with care and expertise.

If you’re a business owner considering retirement, partnering with a business brokerage firm can make all the difference.

Here’s how working with professionals can benefit you and ensure a smooth transition.

1. Maximize the Value of Your Business

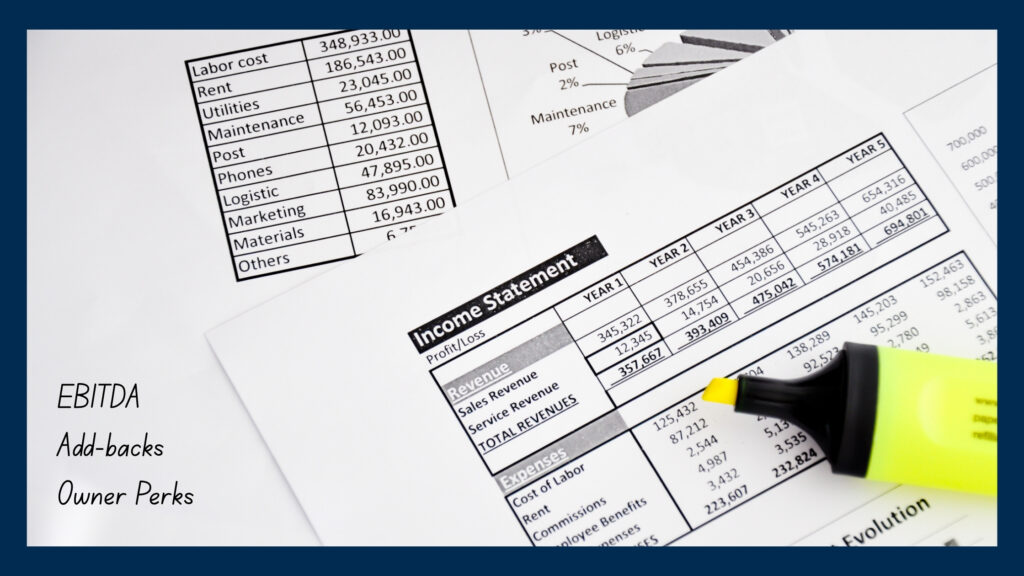

Determining the true value of your business is critical. A professional business broker brings industry expertise and market knowledge to accurately assess your business’s worth. This ensures you get the best possible price, whether through valuation analysis, financial reviews, or highlighting key growth opportunities to potential buyers.

2. Access a Larger Network of Buyers

Finding the right buyer can be challenging. Business brokerage firms have access to an extensive network of qualified buyers, including private investors, private equity groups, and industry professionals. Brokers also know how to market your business confidentially, attracting serious buyers while keeping your plans discreet.

3. Save Time and Reduce Stress

Selling a business is time-intensive, involving everything from marketing the listing to negotiating terms and navigating legal documents. Business owners often don’t have the bandwidth to juggle these responsibilities while managing day-to-day operations. A business brokerage firm handles the entire process, freeing you to focus on maintaining your business’s value until the deal is complete.

4. Ensure a Smooth Transition

Transitioning out of business ownership can be emotional. Brokers are experienced in managing these dynamics and can help align buyer and seller expectations. They guide both parties through due diligence, contracts, and post-sale transitions, ensuring everything runs smoothly.

5. Navigate Legal and Financial Complexities

From non-disclosure agreements to purchase agreements, selling a business involves a significant amount of paperwork. A business brokerage firm works alongside your legal and financial advisors to navigate these complexities, ensuring compliance and protecting your interests.

6. Avoid Common Pitfalls

Selling a business without expert help can lead to costly mistakes, such as undervaluing your business, failing to maintain confidentiality, or missing important deadlines. Brokers have the experience to anticipate and avoid these pitfalls, providing peace of mind during this critical time.

Why Retiring Business Owners Deserve Expert Support

Your business represents years of hard work, sacrifice, and dedication. It’s not just a financial asset—it’s a legacy. By working with a business brokerage firm, you can ensure that your transition into retirement is financially rewarding and stress-free. Whether you plan to spend your days traveling, pursuing hobbies, or simply relaxing, selling your business with the help of a professional allows you to retire with confidence.

Let Us Help You Make the Most of Your Retirement

At Business Broker of America, we specialize in helping retiring business owners like you achieve their goals. With our proven expertise in business sales and a deep understanding of the market, we’ll ensure your hard work translates into a successful and profitable exit.

Ready to take the next step? Contact us today to schedule a consultation and learn how we can help you retire on your terms.