I’m Michelle Regner, founder of Business Brokers of America. I help business owners navigate every step of the sale: from organizing financials to negotiating the right deal, so they feel supported, informed, and in control. My mission is simple: to make sure you exit on your terms, with confidence, clean financials, and a strategy that protects what you’ve built.

With interest rates sitting around 10%, a lot of business owners are asking me whether seller financing is the way to get a deal done. And it’s no surprise since those high SBA rates can shave hundreds of thousands of dollars off a business’s valuation.

Wondering what your business is worth?

Get a personalized valuation backed by real market data.

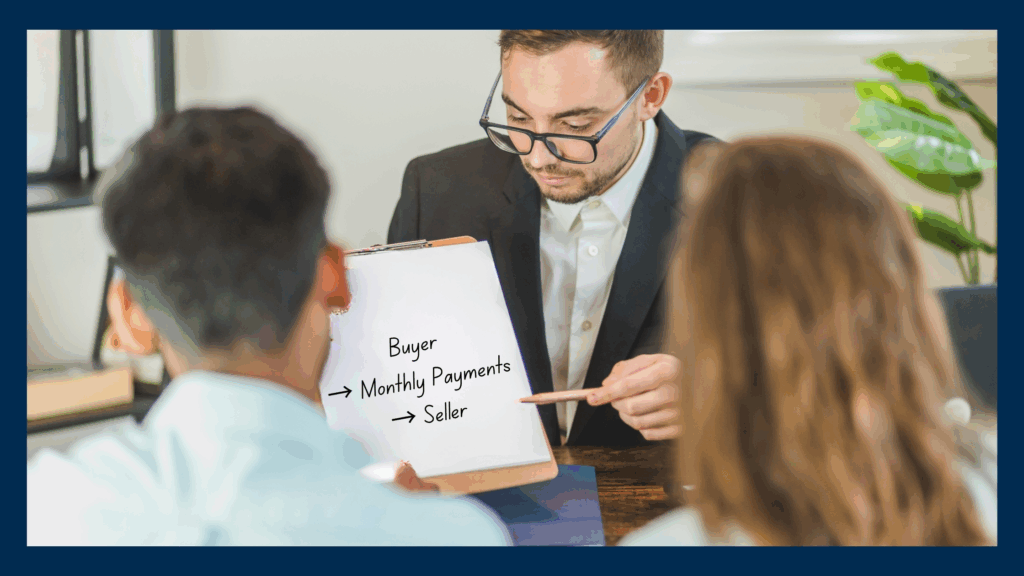

Start your free valuationSeller financing means the seller carries the note themselves, and the buyer pays them back monthly just like a bank loan. It can be a powerful tool to keep deals moving.

But here’s my take: Seller financing is not a substitute for buyer qualification; it’s icing on the cake.

In this guide, I’ll explain how seller financing works, why it’s trending, where it can help or hurt your exit, and how Business Brokers of America (BBA) helps sellers structure these deals safely and profitably.

Related: Planning to sell your business in 2025? These SBA loan changes could make or break your deal

What is seller financing and how does it work?

At its simplest, seller financing is when the seller carries part of the purchase price as a loan to the buyer instead of a bank providing 100% of the financing.

- Buyers usually put down between 20 to 50% upfront.

- The seller carries the balance, typically structured as a note paid off within about three years.

- An attorney documents everything in a promissory note.

- Most of the time, there’s collateral involved. Sometimes they’re putting up a second home or a vehicle, depending on the size of the deal. For higher-value or multi-state deals, you’ll also want to perfect liens and understand each state’s UCC filing requirements; this is an area where BBA’s nationwide team routinely guides clients.

- In today’s climate, seller-financed terms usually land around 6 to 7% interest compared to SBA’s 10%+.

- The big draw is speed. A traditional SBA loan takes 90 to 110 days to close, while seller-financed deals can wrap up in 30 days or less; what I call quick handshake deals.

Buyers love that flexibility because they don’t have to wait on bank committees or third-party approvals, and sellers benefit by moving faster while keeping the price closer to market value.

Related: How to price a business for sale: 7 mistakes that could cost you the deal

Why seller financing is trending now

High interest rates are driving this surge. Here’s a real-world example: A business worth $2 million under normal market conditions could get shaved down to $1.6 million under SBA math because of the interest rate being so high.

It also:

- Expands the buyer pool, especially for younger buyers or first-time entrepreneurs who don’t have deep pockets.

- Closes deals faster (sometimes in half the time).

- Keeps negotiations personal; buyers feel more confident when the seller is willing to back the business. In larger deals, it can also serve as a bridge when banks cap their exposure.

Benefits for sellers and buyers

For sellers, offering terms can feel risky, but here are the upsides when structured correctly:

- Maintain valuation despite market headwinds. You don’t have to accept a discount just because SBA terms are punishing.

- Close quickly. We’ve seen clean deals close in under 30 days.

- Attract more offers. More buyers can step to the table when they’re not 100% dependent on a bank.

- Build buyer trust. When you’re willing to finance part of the deal, buyers see it as proof that you believe in the business. In some cases, you can even negotiate a higher price or better tax treatment through an installment sale structure.

For buyers, seller financing can:

- Faster closes and simpler process (no months-long bank approval).

- Lower interest rates than current SBA loans.

- Confidence boost. If the seller is willing to carry the note, they clearly trust the future of the business.

- Broader access. Even buyers with limited capital can sometimes make the leap.

I once had a 24-year-old buyer purchase a painting business I represented through seller financing. He didn’t have great credit or capital, but the deal worked. Both sides walked away happy.

Related: How to calculate EBITDA—and why it’s just the starting point for serious buyers

The real risks of seller financing

Of course, there are risks on both sides.

For sellers: default is the biggest fear. If the buyer mismanages the business and runs it into the ground, your payouts stop. Repossessing a business is a headache; in multi-state or asset-heavy deals, it can also trigger complex legal battles.

For buyers: if you default, the seller can repossess the business or go after collateral, and you could be left with nothing if things go sideways.

How to mitigate risks:

- Require larger down payments (20–50%).

- Secure strong collateral.

Work with a skilled attorney on the promissory note. - Vet buyers thoroughly; credit, liquidity, industry experience, and yes, even personality fit.

This is where having a broker matters. I’ve personally back-channeled buyers through LinkedIn and discovered red flags, like a past bankruptcy that wasn’t disclosed. That’s the kind of diligence that can save a seller from a costly mistake.

When seller financing does not make sense

It’s not for everyone. Here are the situations where I advise against it:

- You don’t want a longer-term relationship with the buyer. These deals are personal. If you can’t imagine staying involved through the transition, seller financing may not fit.

- Buyer has weak financials or no industry background. Financing someone who has no chance of succeeding isn’t a win for anyone.

- You need a full, immediate cash-out. If you’re retiring or reinvesting right away, you may not want monthly payouts.

As one of my clients once told me bluntly: “I just need to be done. I don’t want to get payments every month… I need to fully retire and not be thinking about it.” And in that case, we went the SBA route.

Related: How to price a business for sale: 7 mistakes that could cost you the deal

Designing a smart seller finance deal

If you do go down this road, here’s what a strong deal looks like:

- Down payment: 20–50%, depending on deal size.

- Interest rate: 6–8% is typical in today’s market.

- Amortization: Aim for full repayment in ~3 years.

- Attorney checklist: promissory note, collateral agreements, and clear transition terms.

BBA’s brokers can model these variables and negotiate terms on your behalf so you’re protected from day one.

Final thoughts

Seller financing can absolutely protect your valuation and speed up your exit, but only when you’ve vetted the buyer and structured the terms carefully.

At Business Brokers of America, we specialize in guiding sellers through this process, from modeling SBA versus seller-financed paths to negotiating collateral, interest, and tax treatment.

If you’re considering an exit, schedule a confidential strategy call with BBA today. We’ll show you exactly how each path impacts your valuation, risk, and payout so you can make the smartest, safest decision for your business.

More about Michelle Regner, Founder & CEO of Business Brokers of America

Michelle Regner is a powerhouse entrepreneur and business strategist with a proven track record of founding and successfully exiting three SaaS technology companies. As the Founder and CEO of Business Brokers of America, she’s on a mission to elevate business brokerage standards nationwide, also serving as President and Managing Partner at Business Brokers of Utah.

Drawing on her firsthand experience launching and scaling startups, Michelle offers unparalleled insight into the realities of small business ownership. She specializes in advising entrepreneurs on growth strategies, exit planning, and digital transformation, having coached dozens to leverage digital marketing, overcome obstacles, and build scalable operational systems.

A Silicon Valley native, Michelle’s entrepreneurial journey began after earning her B.A. in Business from Notre Dame de Namur University and a stint at Morgan Stanley. Her impact quickly gained national recognition, leading to features in Fast Company and being named one of the top business leaders by The Economist in 2014. She’s also a sought-after speaker and previously hosted a five-year podcast series.